I really enjoy reading and highly recommend Michael Fritzell’s Substack- ‘Asian Century Stocks’, and recently had the opportunity to collaborate with him, by analysing Anxian Yuan, HK cemetery operator.

But a couple of weeks ago he wrote an interesting article ‘Analyze capital allocation in 10 easy steps’ based on the book ‘The Essays of Warren Buffett’ and then applying the key learnings to Japanese karaoke bar operator Koshidaka (2157 JP - US$637 million).

As an investor in the Portuguese stock market, this article inspired me to apply those lessons to the Portuguese market, to determine which companies and management teams are truly the best capital allocators. I think its quite an interesting angle to “screen” companies like this, and from there going deeper into other parts of the business or industry.

Source: Euronext Lisbon

Buffett-style skills in Portugal? Is this even possible?

To achieve this, I developed a framework—essentially a filter—based on previous learnings with a few additional refinements. It includes 7 primary categories, plus 3 more that are applied to the top performers. The categories are: Management Guidance, Management Incentives, ROE, ROIC, ROIC-WACC, Balance Sheet, Dividend Payments, Share Buybacks, Mergers, Acquisitions and Divestitures, and Share Issuance. I’m not going too in-depth into each category for this reason I recommend reading ACS article and even ‘The Essays of Warren Buffett’. Basically, the ones I consider positive have a green background, while the negative ones have a red background. Therefore, I will select companies with most positive attributes.

I applied this framework to almost every company listed in Portugal, excluding those that filed for bankruptcy, had secondary listings, or exhibited extreme illiquidity.

So let’s have a look, result is displayed below:

As it is observed the companies that stood out in this framework were:

Corticeira Amorim

CTT

J. Martins

Semapa

Sonae

Navigator

Toyota Caetano

I’ll dive a bit deeper on each one but only into capital allocation.

Corticeira Amorim (COR - €1.14 billion) is the world's largest cork processing group. It is a family-owned business, with the Amorim family controlling 71.41% of the company, including the CEO and Chairman of the Board, António Rios de Amorim, along with other board members.

Source: Corticeira Amorim Website

Management Alignment

Management demonstrates alignment with minority shareholders through significant share ownership. Looking at remuneration, the variable remuneration is tied to net income and is only paid if net income exceeds €40 million (the last time it fell below this threshold was in 2014, somewhat very low target). Currently, approximately 80% of remuneration is fixed; would be better to see more variable component. According to Warren Buffett, the ideal remuneration system should consider profitability adjusted for capital employed. While Corticeira Amorim's remuneration system is not perfect, it is above average compared to other companies in Portugal, mainly because it is based on net income and not EBITDA.

Source: Visão

ROE, ROIC, and ROIC-WACC spread

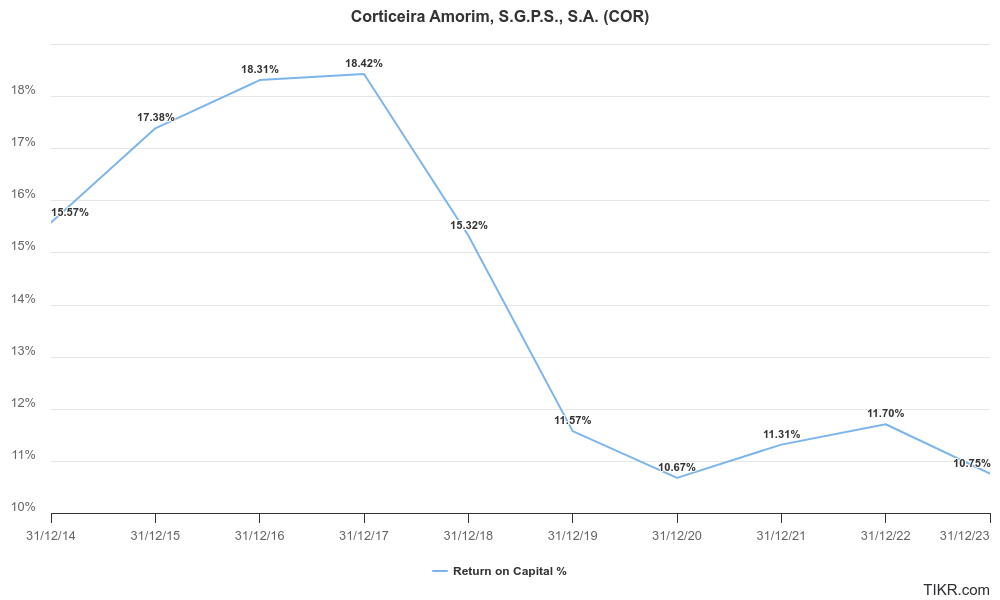

According to Warren Buffett, "The best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return." To assess whether we are looking at a great business, we can analyze the ROE, ROIC, and ROIC-WACC spread, as shown in Figure 1. Corticeira Amorim's ROE and ROIC have both been over 10% for the past 10 years, indicating its a pretty good business, despite being declining over the past 5 years. However, let's first examine the ROIC-WACC spread for a more accurate measure, since WACC can vary based on a company's age, industry, strategy, etc. In 2023, the ROIC-WACC spread stood at 4.75%, indicating that the company is creating sustainable value, although it is not the highest in Portugal. Additionally, ROIIC- Return on Incremental Invested Capital is declining last few years while NOPAT margin improved. This means that the capital allocation is deteriorating slightly.

Source: TIKR

When compared to its French competitor, Oeneo SA, Corticeira Amorim maintained a significantly higher ROIC from 2014 to 2019. However, in recent years, the gap has narrowed, and currently, Oeneo SA is reporting a higher ROIC.

Source: TIKR

Balance Sheet

Corticeira Amorim’s balance sheet has been managed conservatively, company’s net debt as of 1h2024, stood at €237M, this represents net debt to EBITDA of 1,42 times, which is quite conservatively for this kind of business. Additionally, over last 10 years only 4 times net debt to EBITDA has been over 1.

Source: TIKR

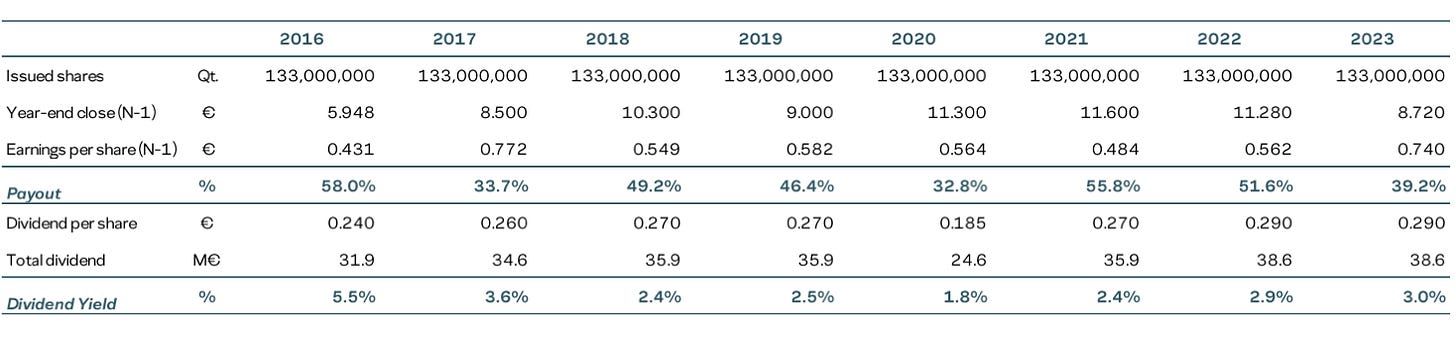

Dividends

Corticeira Amorim has consistently paid dividends nearly every year. Typically, it distributes less 50% of its earnings, resulting in a dividend yield of approximately 3-4%, which is not particularly attractive.

Source: Corticeira Amorim’s Presentation

Share buybacks

Share buybacks have not been a recurring practice for Corticeira Amorim. The largest share buyback program took place from 2010 to 2014, which was impressively well-timed as it coincided with a significant valuation drop, with the P/E ratio falling to the 5-6 range—a level not seen in the following decade. Since then, management has not initiated any further buyback programs.

Mergers, acquisitions & divestitures

Corticeira Amorim has pursued some growth through strategic acquisitions, consistently expanding its portfolio and control over the entire Cork value chain by acquiring stakes in small companies annually. The average transaction value has been around €10 million. These acquisitions appear to be carefully selected, targeting niche areas within the value chain. However, limited financial details are disclosed, specially Net income figures.

Source: Brenko et al. (2019)

Looking at the transactions with “detailed” financial information, for example, acquired 25% stake in US flooring, in 2008, for €10M. This stake was then sold for a net gain of €30M, that’s a CAGR on the investment of 14.70%, which is pretty decent return on investment. In 2017, acquired 60% stake in Bourrassé for €29M, this company in that year generated EBITDA of €7,3M, representing an EBITDA multiple of 6,5. Another example is SACI S.r.l., in which Corticeira Amorim acquired a 50% stake for €48.66 million. In 2020, SACI S.r.l. generated an EBITDA of €10.5 million, resulting in an EBITDA multiple of around 9. It is worth noting that, in this case, the numbers may be slightly depressed due to the impact of the pandemic. Consequently, the normalized multiple should be lower.

Share Issuance

According to Buffett, if the shares of company trade above intrinsic value then it could be a clever idea to issue shares.

In Corticeira Amorim’s case, share issuing is not typically done. In 2000, they issued considerable amount of shares, quite a contrarian and taking advantage of all the froth in the market at that time. However, last time they “issued shares” was 2015, this was not technically an issuance, they simply sold treasury shares hold. Therefore, its share capital didn’t technically increase.

Following the period of share buybacks, these shares were sold for €4,45 a share (P/E 13) to institutional investors. So, they bought back between €0,90-€2 a share (~P/E 5/6), and then sold at €4,45 a share(P/E 13), this seams very well timed and positive. This “issuance” was only available to institutional investors.

From that point onward, they didn’t issued or sold any more shares.

Conclusion

Corticeira Amorim's capital allocation may not be flawless, but the points mentioned earlier demonstrate that it is above average compared to a typical company. I appreciate that the management is aligned through share ownership, the ROE is relatively high, and the positive ROIC-WACC spread indicates value creation. Furthermore, the company's balance sheet is conservatively managed, and it has consistently paid dividends. Recent acquisitions have been made at reasonable prices with no signs of overpaying, reflecting a strategic effort to diversify into areas such as wirehoods for sparkling wines and surbouchage capsules. They bought back shares at low valuation and sold shares at a higher valuation. Additionally, there has been no share issuance in recent years.

I'll cover the companies on the list and aim to identify above average capital allocators.